The margin of safety is $ 20,000, computed as follows:

For example, assume Video Productions currently has sales of $120,000 and its break-even sales are $ 100,000. The margin of safety is the amount by which sales can decrease before the company incurs a loss. If a company’s current sales are more than its break-even point, it has a margin of safety equal to current sales minus break-even sales.

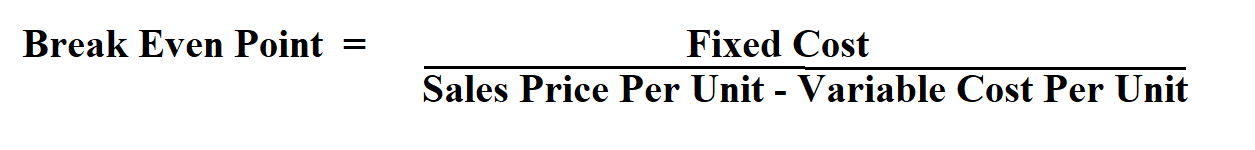

#Break even point formula in dollars per period plus

At this level of sales, fixed costs plus variable costs equal sales revenue, as shown here: Revenue The break-even volume of sales is $ 100,000 (can also be calculated as break even point in units 5,000 units x sales price $ 20 per unit). Using this contribution margin ratio, we calculate Video Production’s break-even point in sales dollars as: BE in Sales Dollars = That is, for each dollar of sales, there is a $ 0.40 left over after variable costs to contribute to covering fixed costs and generating net income. Or, referring to the income statement in which Video Productions had a total contribution margin of $48,000 on revenues of $ 120,000, we compute the contribution margin ratio as contribution margin $48,000 / Revenues $120,000 = 0.40 or 40%. Video Production’s contribution margin ratio is: Contribution Margin Ratio = To calculate this ratio, divide the contribution margin per unit by the selling price per unit, or total contribution margin by total revenues.

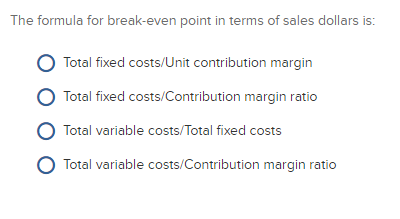

The contribution margin ratio expresses the contribution margin as a percentage of sales.

The formula to compute the break-even point in sales dollars looks a lot like the formula to compute the break-even in units, except we divide fixed costs by the contribution margin ratio instead of the contribution margin per unit. For a company such as GM that makes Cadillacs and certain small components, it makes no sense to think of a break-even point in units. Break-even in sales dollars Companies frequently think of volume in sales dollars instead of units.

0 kommentar(er)

0 kommentar(er)